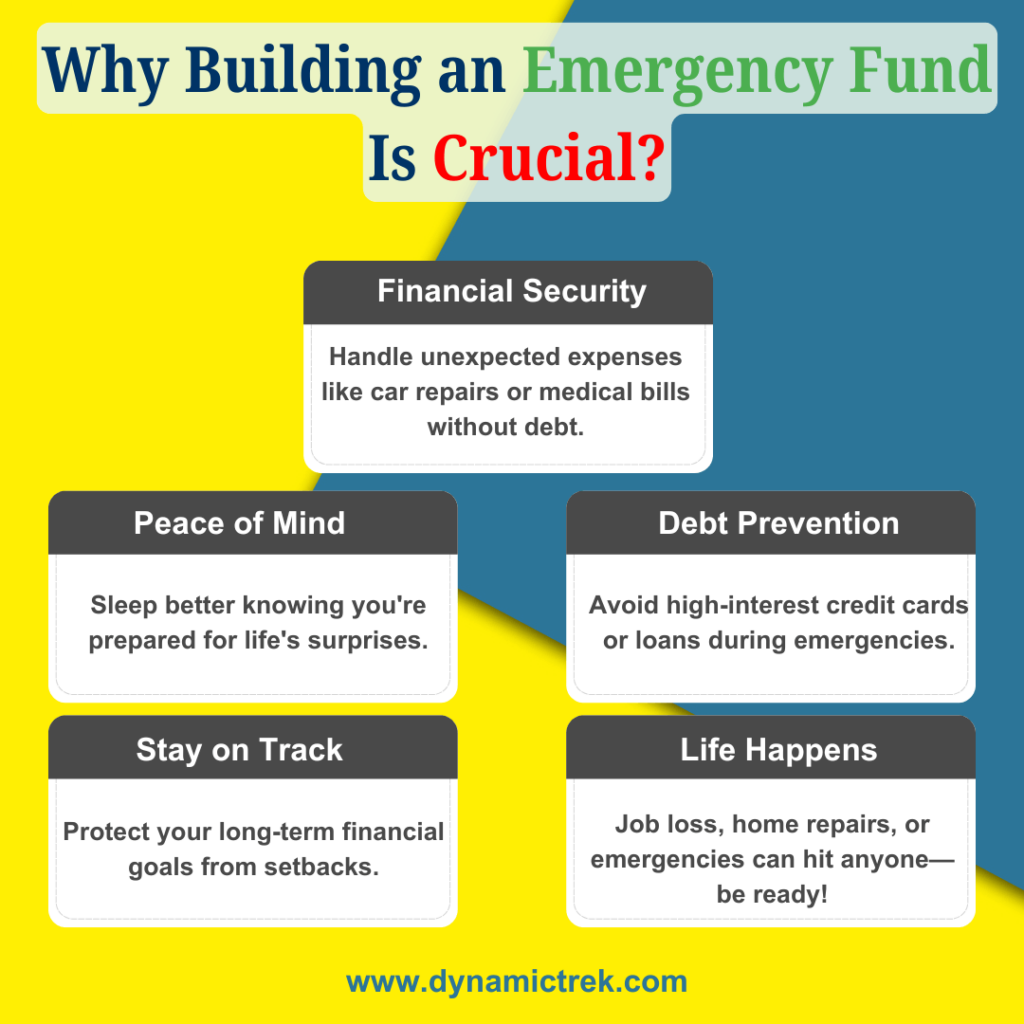

Why Building an Emergency Fund Is Crucial

Did you know that 40% of Americans can’t cover a $400 emergency? Life’s unexpected costs don’t wait—are you prepared? If you want to have a financial safety net, you must have an emergency fund. It’s important for handling life’s surprises! Life is full of surprises. An unwanted medical bill, a broken-down car, or a job loss can be nerve-racking. Having some money set aside makes those unexpected moments a lot less stressful. For instance, an unexpected $1,000 car repair could easily be managed without resorting to high-interest loans. Here’s why you should consider building your own emergency fund:

Financial Security: An emergency fund helps you tackle those unexpected costs without reaching for credit cards or loans, which often come with high-interest rates. During those times, it can be your shield against falling into debt.

Peace of Mind: Knowing that you have some cash set aside for emergencies takes a load off your mind. Life can throw curveballs, but with a fund, you can feel more in control and less anxious when those surprises emerge.

Avoiding Financial Setbacks: If you don’t have a safety net, you might find yourself borrowing money, which can eventually mess with your long-term financial goals. An emergency fund keeps you on track, letting you handle crises easily.

Common Myths About Emergency Funds

People often think they don’t need an emergency fund if they have a stable job or low expenses. But that’s not always the case- emergencies can hit anyone at any time! An emergency fund isn’t just for job loss; it’s a cushion against all kinds of unexpected costs that life can throw your way. Another thing people say I don’t earn enough to save. You can save from what you earn if you get your mind to it. Even small contributions over time can add up significantly and can keep you ready for any emergency.

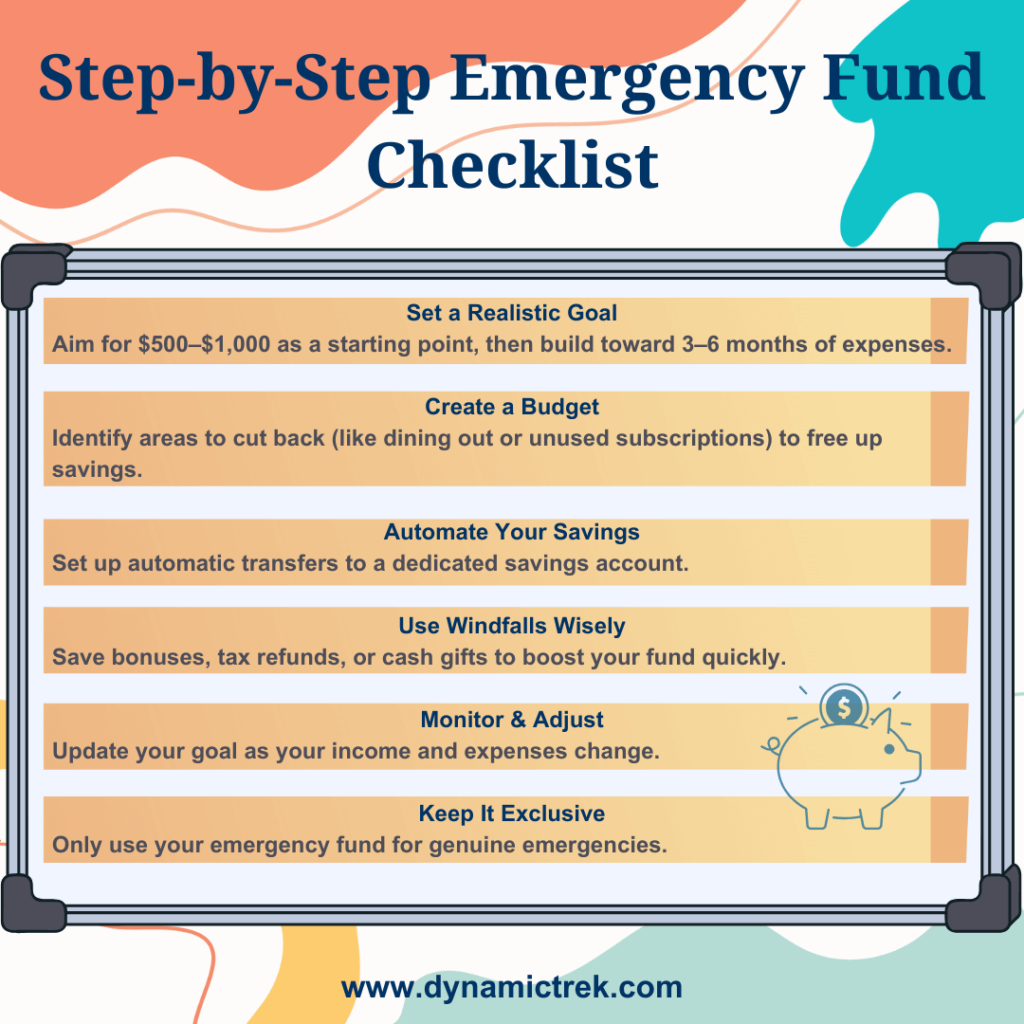

Step by Step Guide to Starting Your Emergency Fund

Ready to start your emergency fund? Here’s how you can get going:

Set a Realistic Goal: Calculate your monthly rent, utilities, and grocery bills to estimate your baseline needs. Always plan to save enough to cover three to six months’ worth of living expenses. If your income takes an unexpected hit, this will help you pay for essential bills. Sometimes it’s difficult to save that amount of cash, don’t worry. Aim for $500 or $1,000 at first, and build from there.

Create a Budget to Identify Savings: Check out your current income and spending habits. Use a budget to find areas where you can spend less – like dining out or unnecessary subscriptions. Every little bit counts! Start by saving just $50 or $100 a month, and increase it as you can.

Automate Your Savings: You can make saving easy by setting up automatic transfers from your checking account to a separate, savings account. Look for high-yield savings accounts that offer easy automation options and competitive interest rates. This way, you won’t need to worry about saving manually!

Use Windfalls and Bonuses: Got a tax refund, work bonus, or unexpected cash gift? Always consider putting some of that money straight into your emergency fund. It’s a quick and efficient way to boost your savings!

Monitor and Adjust: Life is not constant, so you should change your savings plan accordingly. If you get a raise, bump up how much you’re saving each month. If your expenses go up, make sure your emergency fund keeps pace.

Keep It for Emergencies Only: The biggest challenge to maintaining an emergency fund is not using it for non-emergencies. You should always remember- this money is just for unexpected, unavoidable costs. For planned expenses, set up a separate savings goal.

A Step Toward Financial Stability

As change is imminent, building an emergency fund is a crucial step toward a more secure financial future. Start small, be consistent, and stick to your goal. With a little cushion in place, you’ll not only be better prepared for life’s surprises but also enjoy greater peace of mind and independence. So why wait? Start today and give yourself the comfort of being ready for whatever life throws your way!

Check out our article on Mastering Your Budget to gain further insights into taking control of your finances!