Why Budgeting Matters

If you want to take control of your finances, you need to start with budgeting. People often think of a budget as a means of cutting back. But that’s not always true – it’s about understanding where your money goes and making sure it works for you. Having a budget will help you whether you’re saving for a big goal, trying to pay off debt, or just want to stress less about bills. It gives you a clear plan and lets you make confident decisions about your spending and saving. With the right budgeting tips, you can take charge of your finances and achieve the financial freedom you’ve always wanted.

Budgeting Tips 101: Understand Your Income and Expenses

First thing you need to know before you start your budget is exactly how much money is coming in and where it’s going. You should list all your sources of income, whether it’s a regular paycheck, freelance work, or a side gig. Once you have your total income, break down your expenses into two categories:

Fixed expenses: These are your regular, unavoidable costs like rent, utilities, or car payments.

Variable expenses: These can change month to month, like groceries, dining out, or entertainment.

By tracking both your income and expenses, you’ll have a clear picture of your financial situation and can start making adjustments where needed.

Choosing a Simple Budgeting Method

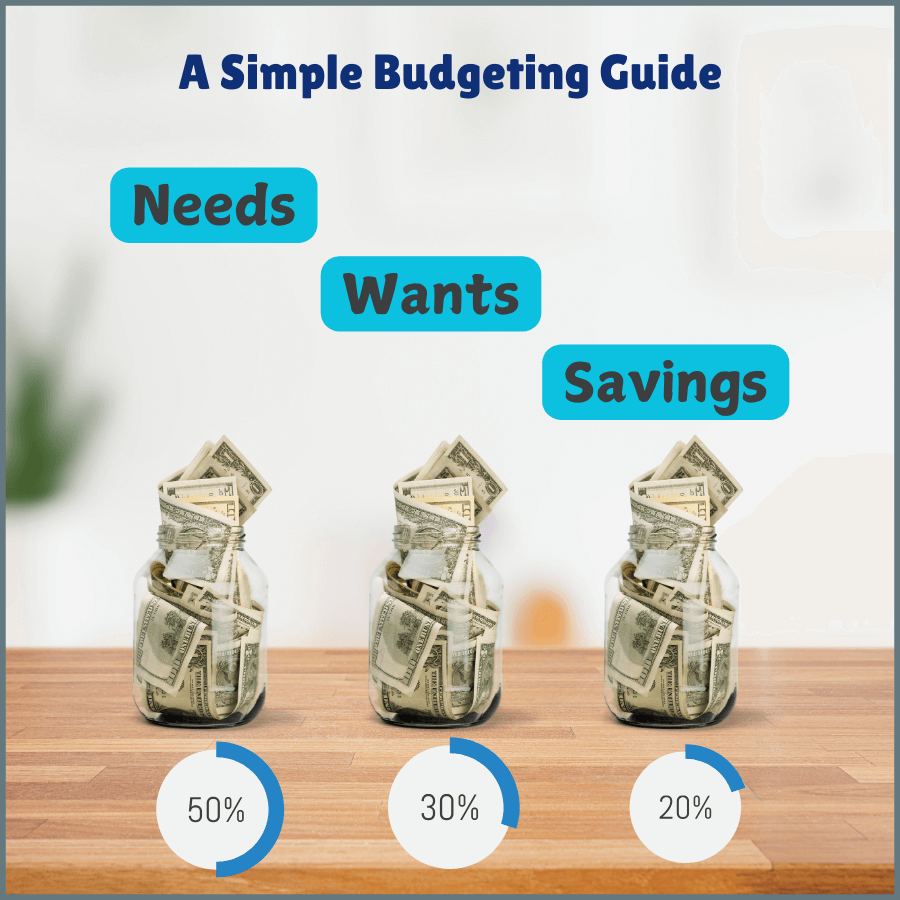

Now that you have figured out your income and expenses, it’s time to pick a suitable budgeting method. One of the simplest and most popular options is the 50/30/20 Rule:

- Separate 50% of your income for needs, like rent, utilities, and groceries.

- Use 30% for wants, such as dining out, hobbies, and entertainment.

- Keep 20% for savings or debt repayment.

This method is easy to follow and flexible enough for most people. If the 50/30/20 rule doesn’t fit your situation, consider other options like zero-based budgeting, where every dollar is assigned a purpose. The key is to find a system that feels comfortable and keeps you on track.

Setting Financial Goals

You should have clear goals in your mind to set up a budget. You can start by forming not only short-term but also long-term financial goals. Short-term goals might include paying off a credit card debt or building an emergency fund. Long-term goals could be saving for retirement or buying a house.

When you have a clear picture of what you’re working toward, it’s easier to stay motivated and make decisions that align with those goals. Maybe you’re saving up for something fun or planning for the future, having goals gives your budget direction and purpose.

Tools to Simplify Budgeting

Nowadays, we have advanced technology that makes our life easier. There are plenty of budgeting apps that help us manage our finances. Popular options like Mint or YNAB (You Need a Budget) allow you to track expenses, set goals, and even get notifications when you’re overspending.

If you’re old-school and prefer a more hands-on approach, a simple spreadsheet can work just as well. You can manually enter your income and expenses, giving you full control over the numbers.

Another great tip is to automate your finances—set up automatic transfers for savings or bill payments, so you don’t have to think about it. This keeps you on track and helps you stick to your budget effortlessly.

Staying Consistent and Flexible

Any Tom, Dick or Harry can create a budget—sticking to it is where the real challenge comes in. If you want to stay consistent, you should review your budget at the end of each month. This helps you see where you’re doing well and where you might need to adjust.

Remember, budgeting doesn’t have to be rigid. Life happens, and sometimes unexpected expenses come up. You should be ready to stay flexible and make adjustments when necessary. Whether that means cutting back on dining out or increasing your savings after a bonus, you should go for it.

Consistency and flexibility are what make budgeting sustainable over the long term, so don’t be too hard on yourself if things change—just adapt and keep moving forward.

Start Today, See Results Tomorrow

At first all these budgeting tips might seem overwhelming, but once you start, you’ll see how empowering it can be. It’s all about taking small steps to take control of your money and work toward your financial goals. Whether you’re saving for something big or just want peace of mind, having a budget gives you a clear idea on how to make it happen. Start today, follow these budgeting tips to find one that suits you; stick with it, and watch your financial situation improve one step at a time.

Looking to boost your income even further? Check out our next article on Flexible Side Gigs: 10 Easy Ways to Increase Your Earnings and start earning extra today!